In cell c8 create a formula using the fv function – In the realm of financial calculations, the FV function stands tall, empowering users to peer into the future and determine the value of their investments or savings. This guide delves into the intricacies of the FV function, unveiling its syntax, financial implications, and practical applications, culminating in a comprehensive understanding of its utility in financial planning and analysis.

Beyond its theoretical underpinnings, this guide also provides a practical walkthrough of implementing the FV function in Microsoft Excel, ensuring that readers can seamlessly integrate this powerful tool into their financial models and decision-making processes.

Formula Syntax and Arguments: In Cell C8 Create A Formula Using The Fv Function

The FV function in Microsoft Excel is used to calculate the future value of an investment based on a series of periodic payments and a fixed interest rate. The syntax of the FV function is as follows:

FV(rate, nper, pmt, [pv], [type])

Where:

- rateis the annual interest rate.

- nperis the total number of periods (e.g., months or years).

- pmtis the periodic payment amount.

- pvis the present value (optional; default is 0).

- typeis the timing of the payments (optional; default is 0 for end of period, 1 for beginning of period).

Financial Interpretation

The FV function calculates the future value of an investment, which is the amount of money that the investment will be worth at a specific point in time in the future. The future value is calculated using the following formula:

FV = PV

(1 + r)^n

Where:

- FVis the future value.

- PVis the present value.

- ris the annual interest rate.

- nis the number of periods.

The FV function is useful for financial planning and analysis because it allows users to determine the future value of investments and savings goals. It can also be used to calculate the future value of loans and other financial obligations.

Practical Applications, In cell c8 create a formula using the fv function

The FV function can be used in a variety of financial planning and analysis applications. Some common examples include:

- Calculating future savings goals:The FV function can be used to calculate the future value of a savings goal, such as a retirement fund or a down payment on a house.

- Estimating investment returns:The FV function can be used to estimate the future value of an investment, such as a stock or bond.

- Calculating loan payments:The FV function can be used to calculate the future value of a loan, such as a mortgage or a car loan.

Excel Implementation

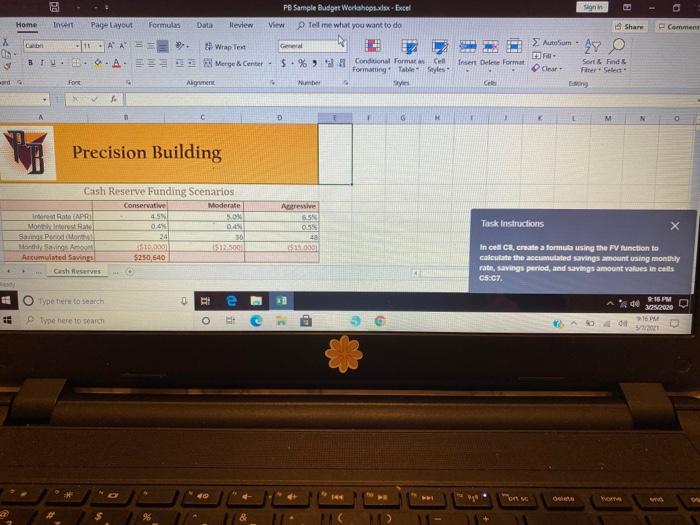

To create a formula using the FV function in Microsoft Excel, follow these steps:

- Select the cell where you want to display the future value.

- Click on the “Insert Function” button (fx).

- Select the “Financial” category.

- Select the “FV” function.

- Enter the following arguments into the function dialog box:

- Rate:The annual interest rate.

- Nper:The total number of periods.

- Pmt:The periodic payment amount.

- Pv:The present value (optional; default is 0).

- Type:The timing of the payments (optional; default is 0 for end of period, 1 for beginning of period).

- Click “OK” to insert the function into the cell.

Troubleshooting and Errors

Common errors that can occur when using the FV function include:

- #NUM!:This error occurs when the number of periods is negative or zero.

- #VALUE!:This error occurs when the interest rate, periodic payment amount, or present value is not a valid number.

- #REF!:This error occurs when the cell reference for the interest rate, periodic payment amount, or present value is invalid.

To troubleshoot and resolve these errors, check the following:

- Make sure that the number of periods is positive and non-zero.

- Make sure that the interest rate, periodic payment amount, and present value are valid numbers.

- Make sure that the cell references for the interest rate, periodic payment amount, and present value are valid.

Expert Answers

What is the syntax of the FV function?

The syntax of the FV function is: =FV(rate, nper, pmt, [pv], [type])

What is the financial interpretation of the FV function?

The FV function calculates the future value of an investment or savings account, taking into account the effects of compounding interest.

How can I use the FV function in Excel?

To use the FV function in Excel, simply enter the following formula into a cell: =FV(rate, nper, pmt, [pv], [type])